To prepare for fluctuating or unexpected expenditures, disciplined landlords and investors, will set aside a set percentage of their rental income into savings each month. For example, do you know what you will do when maintenance costs increase sharply in the winter? Setting aside these savings provides a buffer against derailing your finances. Over time, your historical financial data will help you forecast these costs with greater accuracy. Set yourself up for success by separating your personal and business finances with proper rental property bookkeeping.

Landlord accounting software and reporting tools allow you to automate and capture the financial status of your rental property with minimal effort. You can save time, keep all your transactions organized, and get useful insights into how your rental business is performing. Furthermore, having a separate bank account for each rental property becomes more important once you start scaling your portfolio. Over time, you’ll have more transactions to manage, which means you’ll need to maintain accurate books.

Airbnb Income Expense Tracker For Excel, Airbnb Rental Excel Spreadsheet Template, Airbnb Bookkeeping, Rental Management

It’s highly recommended that rental property businesses digitize such things as receipts with rental property accounting apps. Digitization declutters your office by organizing your receipts digitally and makes it much easier to access specific receipts during tax time or audits. Below is a list of the top tips for rental property accounting to help you stay organized and keep your financial records and reports well maintained. The amount of rental income you are going to declare depends on the form of accounting that you use. The most popular way is called the “cash-basis method,” and it requires you to report income as soon as you receive it and report expenses when you pay them. Another way of accounting for your rental income is the “accrual method,” which means you report your income when it’s earned and not when it’s received.

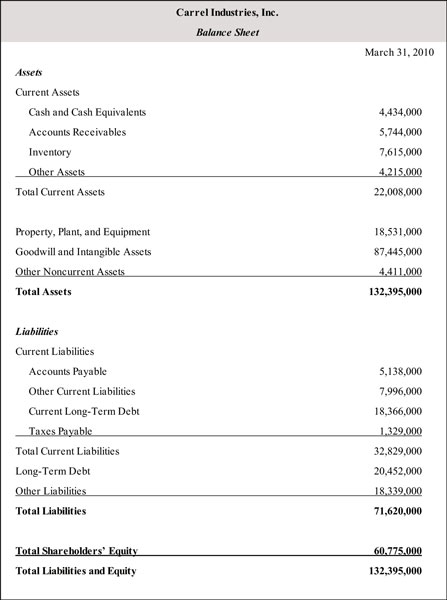

When a landlord receives a security deposit, it is booked as a short-term liability on the balance sheet, because it is money the landlord owes the tenant when the lease ends. An overview on the benefits and drawbacks of using an LLC with your income properties, along with the cost, ownership structure, asset protection, and financing implications. Reports are a quick reference point to determine how well your business is running.

Track and Categorize Expenses Regularly

This means marketing your property, staying on top of real estate trends, communicating with your tenants, keeping a regular maintenance schedule, and staying on top of your bookkeeping and taxes. Although some real estate owners use standard worksheets to record their transactions, this Rental property bookkeeping form of bookkeeping might become slightly overwhelming if you manage several properties and need a reliable system in place. That’s where good accounting software comes in, and while it might cost you upwards of a few hundred dollars a month, it will make the process a whole lot easier.

- Azibo Accounting was built for landlords frustrated with their current bookkeeping solutions.

- Properties can be single-unit or multi-unit, with no limit on how many units can be in a property.

- Smoothly getting up and running is great, but over time you’ll want your accounting system to begin doing the work for you.

- Real estate investors can deduct a range of expenses to reduce their tax liability.

- The problem is that, as you grow, you’ll quickly notice that QuickBooks isn’t designed for managing rental properties.

While your rental property is considered an asset, the income you derive from it is not. In addition to an array of features such as automated late fees, smart bill entry, relaxed-time reporting, and utility management, it also offers free training and resources as well as customer support. Make sure to keep your business-unrelated day-to-day expenses away from this account because the entire purpose of this set-up is to create a separate account for your business bills.

Put your portfolio on autopilot with DoorLoop

It’s also the easiest way to stay organized and simplify your reconciliation tasks. Appfolio requires a $400 onboarding fee, in addition to a monthly per-unit fee that ranges from one type of property to another. Since the minimum monthly fee is $250, Appfolio is best suited for property managers with at least 50 units.

Download this rental property expense spreadsheet template to help you set up your rental property bookkeeping today. Digitization will help you declutter your office, stay on top of your invoicing and even contribute to saving the planet. If you’d like to share data with professionals across your team, cloud-based software may be your best option. Visit this resource for recommendations on the best financial software for real estate investors.

Rental Property Accounting Tips

One of the most important goals you’re trying to accomplish here is separating your business finances from your personal finances. It makes it easier to track how your business is performing, it’ll make you more organized come tax time, and it will keep you from making a costly mistake that leads to an IRS audit. Owning and operating a profitable rental property portfolio requires many things, not the least of which are systems.

MRI Software has been in business since 1971, a testament to its reliability and expertise in providing a variety of services to clients across different industries. Because of the many features and the option to add additional tools, commercial users would be able to optimize MRI Software as well as their partner relationships. The customer support staff is also praised for their knowledge of all features, including the latest upgrades. Buildium has a high rating across different review websites, serving as a testament to the reliable service they provide. Buildium integrates with several outside software platforms, including TransUnion, RevSpring, MSI, Nelco, Happy Inspector, PayNearMe, and more. This solid list of integrations, the recognition it has received from G2 and Capterra, and its active updates to resolve issues make it a reliable platform.

Real Estate Absorption Rate and What it Means for Investors

In both of these examples you have a reported net income of $500, but your actual cash flow for the month is different. For example, if you bill the tenant for $2,000 in rent in June but the tenant doesn’t pay, you still have income and a receivable of $2,000 based on the accrual method. If you receive $1,500 in bills for the month but don’t actually pay them until July, you still have an expense and payable amount of $1,500.

Personally, I have two distinctly separate checking accounts (complete with debit cards and check books) for my two rental properties. I make sure all income and expense items flow through the respective checking accounts. At year-end when it’s time to compile my profit and loss statements, if I’ve done a great job at upholding the integrity of the sub-processes, it’s very easy to quickly record my income and expense items. You’ll use Form 1040 for your individual income tax return, but you’ll also need to report income and expenses for your rental properties. The form you’ll use to do this will depend on whether your rental properties are considered personal or real estate property rentals.

Whether you choose to keep your accounting services in-house or select a partner to outsource, the person who is at the helm of your accounting should be an expert in the software that your business needs today. Not only that, but they must also be able to implement new technologies as the needs of the business change. Someone who understands the industry of short-term rentals specifically will be able to help you make strategic choices and provide insights based on relevant experience.

Guide to Rental Property Bookkeeping

In this article, we share some tips and tricks as well as tools to make rental property accounting easier for landlords. If you don’t already have a solid rental property accounting system in place, your first step will be to get organized—and that means locating all of your financial records. This will likely involve looking through your credit card and bank statements to track income and expenses for each of your properties. Once you have set up separate accounts for each of your properties, you will be ready to start tracking your expenses. First, you will need a reliable system for tracking the inflows and outflows of cash for your properties and your business overall. Some business owners might design their own expense worksheets, while others will elect to use rental property accounting software to keep track of their finances.

Topkey notches $5.2m in seed funding round – Short Term Rentalz

Topkey notches $5.2m in seed funding round.

Posted: Thu, 06 Jul 2023 09:02:26 GMT [source]

Yes, REI Hub is a double-entry accounting system (similar to general small business accounting systems like QuickBooks or Xero). Double-entry accounting is a generally accepted standard and enables advanced reporting like a Balance Sheet and Fixed Asset/ Depreciation tracking. Certified Public Accountant – Hiring professionals like a CPA is one of the smartest choices you can make in this line of business since they are more experienced and more familiar with accounting systems. They can direct you properly on how you can approach and analyze your finances in the best way possible. Sharing responsibilities between two or more people or having co-workers review critical tasks can help provide some controls against errors or fraud. But you still need to have someone with the right experience and skills to know how to manage the accounting for vacation rentals in the first place.

- Although QuickBooks is not designed for managing properties, DoorLoop offers a convenient integration with QuickBooks.

- Packages cost $35 to $40 per month, with the pricing based on the number of units you’re managing.

- The following basic principles will help you develop an efficient rental property accounting system for your real estate business.

- So here’s what you need to know about managing your finances as a landlord (and how to do it well).

- The fast-moving nature of the vacation rental industry requires extremely detailed accounting.

Another important step in setting up a rental property accounting system is choosing which method of accounting to use. With the cash method, expenses and income are recorded when the cash is paid or received. Early in your investing career, you wanted to keep things as simple as possible. You bought rental property and just had the income and expenses flow through to your personal account. You did a decent job of tracking everything in Excel and you know your process could be better but you are striving to keep things simple.