The Treasury Bills are freely transferable and negotiable instruments and are issued at a discount. As Treasury Bills are issued by the Reserve credit instrument through which bank deposits are transferable Bank of India, they are considered the safest investments. The maturity period of the Treasury Bills varies from 14 days to 364 days.

The study discovers that a more concentrated banking industry results in fewer funding barriers for SMEs. Small businesses operating in highly concentrated marketplaces have more access to both long and short term bank loans and pay cheaper interest rates. The findings are explained by the fact that creditors with higher market power are more forthcoming and have a larger motivation to spend in getting information about private firms. SMEs situated in nations with a larger concentration of foreign bank ownership face greater access barriers and higher borrowing costs. These are also a consequence of international banks‘ difficulties when it comes to relationship lending to opaque small enterprises based on soft data. Savings are better mobilised when they are transformed into investments with the assistance of financial institutions.

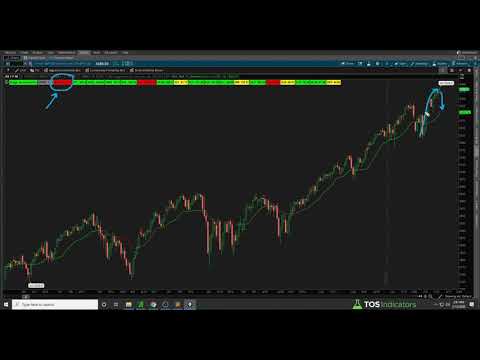

A functional representation of the banking system through three layered levels

Shadow banking has been adding hazardous coordination links across financial institutions, making it more sensitive to credit and market shocks. Relative to the cash-in-advance settlement system (first layered level), the bank credit system introduces flexibility across space and time. On the one hand, banks economise on cash transfers by managing inter-bank transactions. On the other hand, banks enable agents to displace cash settlements through time and space.

While insurance policies are not considered securities, one could possibly view them an alternative type of financial instrument because they confer a claim and certain rights to the policyholder and obligations to the insurer. Developing an applied analysis concerning financial regulation and supervision, and the variety of institutional architectures and regulatory reform proposals is outside the scope of our theoretical analysis. In fact, some general thoughts may be summarised here to identify some milestones for the regulatory mapping to be taken into consideration. The critical feature here is that the more this transfer may be effectuated at will and at par, the more these transferable securities resemble to money.Sayers, 1938, p. 159).

AND CREDIT CREATION

Multiple bank regulators encourage cautious lending by banks and help some SMEs by lowering financing costs. Multiple bank regulators, on the other hand, hurt other SMEs by worsening their difficulties obtaining bank loans. Bank regulatory procedures that impose stricter limits on how much information banks must disclose to the public contribute to SMEs‘ ease of access to more structured loans, which is consistent with the private interest position.

Successive layered levels of the working of the banking system and related institutional instrumentalities. Corporate finance is a subset of finance that focuses on the financial choices made by businesses and the tools and analysis used to make these decisions. Corporate finance’s fundamental objective is to increase a company’s value without incurring undue financial risks. CG is about more than simply openness, disclosure, accountability, and ethical business practises. According to the Kumar Mangalam Birla Committee (2000), there is a correlation between CG levels and corporate success, with well-managed businesses with high CG having higher values. FEM is the market place where currencies are transacted from one nation (say, PKR) to another (say, US$).

A long-standing debate has been occurring between state and private theories of money. Under the functional equivalence between currency and deposit, money generation can emerge through both issuance of cash-equivalent assets, and granting of drawing credit facilities. Both issuance and granting may be performed by public and private members of the monetary system.

The hierarchy of money

The findings provide substantial evidence in favour of the information-based theory. Barter was the term used to describe this exchange of commodities for goods. This situation gives rise to something that Perry Mehrling, professor of economics at Boston University and proponent of the „Money View“, refers to as the natural hierarchy of money.

Form F-1 RanMarine Technology – StreetInsider.com

Form F-1 RanMarine Technology.

Posted: Tue, 11 Jul 2023 07:00:00 GMT [source]

While shareholder equity injection is supposed to be provided by outside investors in loss-bearing irredeemable dividend-remunerated bank capital, reserve provisioning is retained from earnings that are internally generated by the ongoing bank entity. Bank equity regulation, including capital requirements and prudential reserves policy, points to this dimension. This intermediation by decentralised monetary institutions does not change the payments system that is in place in this miniature economy.

Current (Demand Deposit) Account

Therefore banks do not only keep currency money accounts on behalf of agents, but they may also perform specific credit operations which finance the ongoing economic activities run by agents. This specific banking activity operates under an institutional ruling that enables credit (Table 4). Through credit, agents are no longer constrained by current currency money holdings, but they can lend and borrow to each other. This involves postponing or anticipating payments, but also settling a payment by a promise to pay, instead of a currency money transfer. Here, money holdings and inflows further define each agent’s capacity to settle its debt obligations, defining money as means of debt settlement, that is, its redeeming or releasing power. In sum, the bank credit department seeks to generate assets to the bank entity in view to earn income, including remuneration for bank stakeholders such as management and shareholders.

- Ariel Courage is an experienced editor, researcher, and former fact-checker.

- Money’s worth is inextricably linked to the pricing of products and services.

- Its collective and dynamic nature should indeed be considered and accounted for as a going concern.

- This banking regime is usually labelled ‘fractional reserve’ or ‘deposit creation’.

- In Germany and Japan bank loans represent an even larger share of total business funding.

Businesses need such capital for long-term investments and day-to-day operations. Banks, insurance companies, mutual funds, investment banks, savings banks, and financing banks are all types of financial intermediaries that accept household deposits and lend them to businesses and consumers. In exchange for families‘ savings, it pays reduced interest to households but charges high interest to businesses or consumers for loans.

Accordingly, entrepreneurial finance encompasses a wide range of subtopics, including financial contracts, financial gaps, capital availability, public policy, and international disparities resulting from differences in institutions and cultures (Cumming, 2012). Because these subjects are broad and complicated, most research on entrepreneurial finance often concentrate on just one of them at a time (Cumming, 2012). By and large, investment banks in India are institutions that earn money via the capital market, venture capital, or private equity. Banks are innovating nowadays with a variety of financial tools and alternatives, ranging from information technology to e-finance.

The capital stock paid by shareholders becomes the bank’s operating capital. To safeguard the bank’s depositors, the operating capital is placed in a trust fund. In exchange, stockholders get certificates attesting to their ownership of bank stock.

Here advocacy for mark-to-market accounting appears to involve a fundamental misunderstanding of a banking system jointly composed by ongoing entities, financial markets, and financial transactions.Anthony, 2004). In this context, it is important to remind that financial dynamics does not occur in a vacuum. The recent transformations in behavioural and institutional conditions created the very possibility of the North-Atlantic Financial Crisis to occur (Biondi, 2016b). These two dimensions go along generally together in finance, with financial regulation changes accompanying changes in bank management and corporate governance.

The fourth part defines inflation macroeconomically, as the process through which money is created. The fifth portion examines the monetary-structural causes of financial crises, while the sixth section discusses the various financial rules that exist or are being proposed at the time of writing. The seventh part makes the case for banking structural and monetary change in order to avert future systemic crises. The concluding section summarises the important points made throughout this work. Without money, products and services would be without a price, since there would be no objective means of determining their worth. Indeed, utility is a subjective, unquantifiable characteristic of every item.

Different subcategories of each instrument type exist, such as preferred share equity and common share equity. Much has been written concerning shadow banking in the wake of the ‘North-Atlantic Financial Crisis’ (Biondi, 2016b; ECB 2015; Financial Stability Board – FSB, 2015). Collateralised refinancing by an illustrative bank A – Suggested on-balance sheet presentation. Moreover, the banking system may provoke inflation by granting its credit facilities in a credit bubble.Hawtrey (1932), ‘The Inherent Instability of Credit’, p. 168. The theory of money emissions, pp. 121–138 in A Handbook of Alternative Monetary Economics.

If the insurer is a mutual company, the policy may also confer ownership and a claim to dividends. Insurance policies also have a specified value in terms of both the death benefit and living benefits (e.g., cash value) for permanent policies. Foreign exchange (forex, or FX) instruments include derivatives such as forwards, futures, and options on currency pairs, as well as contracts for difference (CFDs). In addition, forex traders may engage in spot transactions for the immediate conversion of one currency into another. Foreign exchange instruments comprise a third, unique type of financial instrument.

A market for short-term funds that are meant to use for a period of up to one year is known as Money Market. In the general case, the money market is the source of funds or finance for working capital. The transactions held in the money market involve lending and borrowing of cash for a short term and also consist of the sale and purchase of securities with one year term or securities which get paid back (redeemed) within one year.